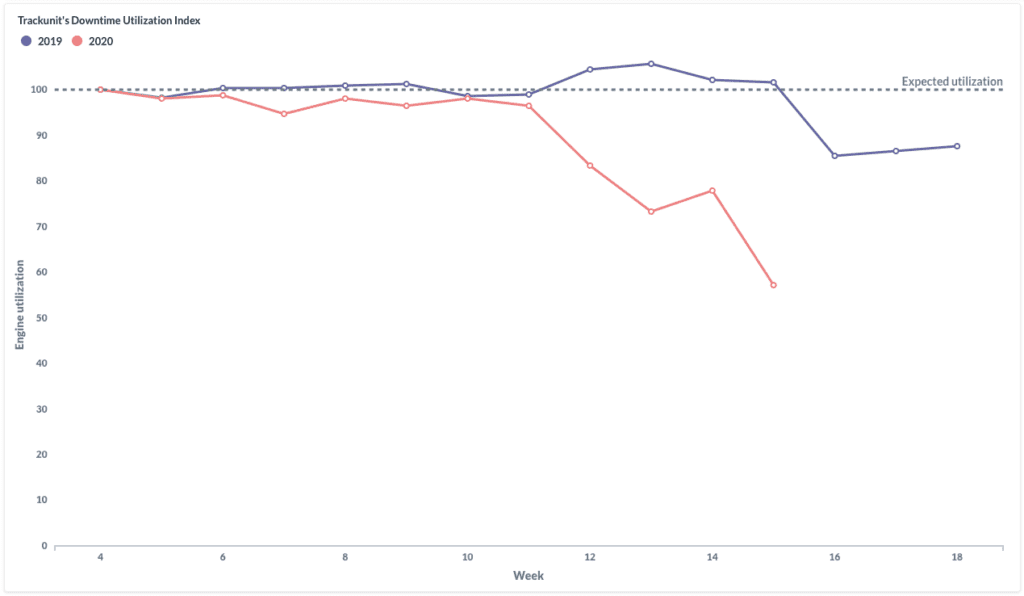

Holiday usually means downtime for us, our loved ones and our machines. Last year, machine utilization dropped with 15% during Easter, but this year shows a 26% decrease. The data speaks for itself; A net decrease of 11% tells us that COVID-19 fear still slashes machine uptime. Our advice to construction executives is to collaborate, collaborate and collaborate.

The Downtime Index compiles weekly harmonized engine utilization changes. Engine utilization is defined as voltage activity on a machine’s alternator. We express the changes as index numbers to allow for quick international comparisons. The index starts at week 4 and is referred to as the base week. In subsequent weeks, percentage increases push the index number above 100, and percentage decreases push the figure below 100. An index number of 102 means a 2% rise from the base week, and an index number of 98 means a 2% fall. The underlying data comes from a fully anonymized cohort of approximately 150,000 off-highway construction machines in Europe and North America with high densities in France, Germany, Denmark and the US (40% all together).

Holiday usually means downtime for us, our loved ones and our machines. Last year, machine utilization dropped with 15% during Easter, but this year shows a 26% decrease. The data speaks for itself; A net decrease of 11% tells us that covid-19 fear still slashes machine uptime.

Machines are now being utilized 44% less compared to 2019. This is the biggest gap we have seen so far in the Downtime Index and we’re eager to see how utilization picks up after Easter.

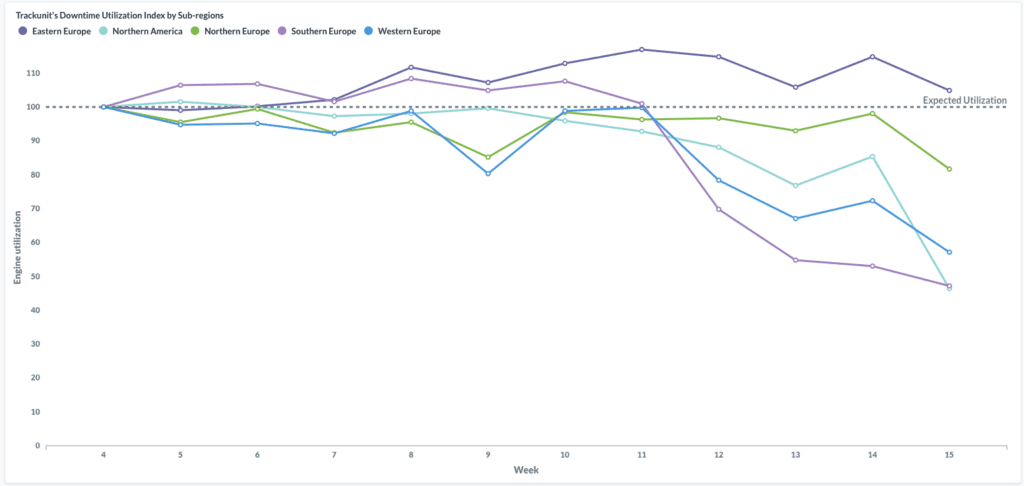

The quick spread of COVID-19 has shaken North American construction sites which is evident from a shocking 45% drop in machine utilization from week 14 to 15. Simultaneously, we see a decrease of 15% in Europe. This clearly indicates that the gap between Europe and North America widens when it comes to machine utilization.

Within Europe we also see strong gaps emerging. France, Spain and Italy are still on a significant downward trend with France being at only 20% of expected utilization. However, Eastern European countries such as Romania, Estonia, Lithuania and Czechia have lifted the average of Europe’s Downtime Index to 74. It tells us that the impact from COVID-19 on the construction industry varies greatly by governmental strategies and that some countries are able to keep domestic demand high despite the turbulence. Even if we adjust for the amount of COVID-19 cases, we see that the Eastern European countries leapfrog other countries on machine utilization.

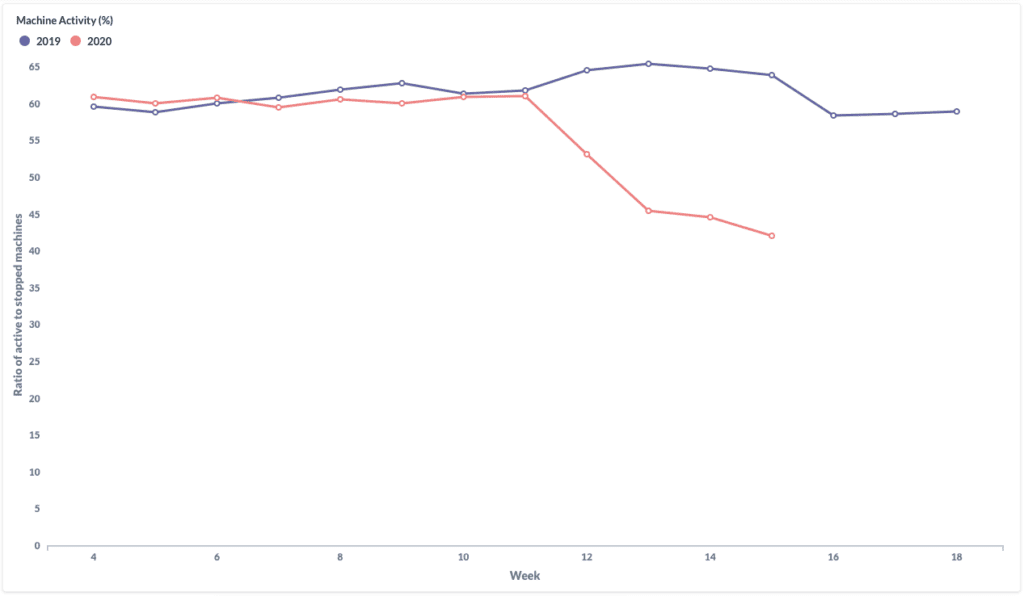

The construction sector slowdown is also evident from the machine activity rate. In week 15, the rate dropped to 42% which means that less than half of all machines were being used. If we assume an average weight of 4 tons per machine, this means that 350K tons of heavy machinery were not being used last week. For the machine activity rate, we also see a widening gap between Europe and North America with a 6 and 14% drop, respectively.

“Test, test and test” sounded the key message of WHO to all policy makers a few months ago by its director general Tedros Adhanom Ghebreyesus. Our advice to construction executives is to: Collaborate, collaborate and collaborate. We think that the following actions can help construction overcome the ongoing challenge of COVID-19’s impact and benefit from it when the economy rebounds.

OEMs support their suppliers

While top suppliers are likely to be in robust shape, others might be facing cash flow issues. Proactive communication and risk assessment is key. Some suppliers may not be able to restart their production and shipping, new supplier qualifications are conducted at an ever high pace. These crisis situations provide an opportunity for OEMs to engage with their suppliers at an even higher level and pull their key components at arms length. Solutions might include specialized supply chain finance and earlier settlement. Close collaboration across the supply chain will increase cross-tier transparency.

Rentals step closer to digital demand management

While some rentals already started looking for digital ways of demand management, others fail to support their long-lasting loyal customers. Some rentals have turned to online demand generation to get around lockdowns, however, physical depots are likely to be permanent for many years to come. The next step is to reimagine the renting and after-return processes to exploit the full potential of digital technology. Reinventing traditional process together with customers will not only increase transparency but build loyalty that is essential in crisis times.

Contractors support clients on material delay

Containment efforts and quarantines have slowed or shut down factories in dozens of countries, leading to forecasts of a sharp fall-off in production of everything from steel and stone to millwork and plumbing fixtures. Supply shortages are expected to impact all infrastructure and home builders. In order to make sure project delays are calculated and handled in the best possible way, contractors openly discuss material delays and help support clients in rescheduling and related risk management.

Get in touch with us in case you have any questions or comments on [email protected]. Share your response or insight on social media with #eliminatedowntime