Something very immediate is evident when you spend time in the company of Fabian Metzeler. Yes, he’s passionate about construction. And yes, he believes the opportunity in construction is potentially massive over the next few years.

But, as you might expect from someone whose day job is at global consultancy McKinsey, he’s also armed with a raft of facts and figures that complement his passion with the kind of hard data that makes for a compelling case.

Take, as an example, his firm conviction that investor interest in the construction industry has hit a tipping point and is about to go through the roof over the next few years, especially if the drive towards more sustainability-led building methods gathers pace.

“Investors are suddenly looking at construction and thinking here’s an industry with tremendous potential especially given the requirements imposed by the drive to meet emissions goals,” he says. “That interest has really accelerated in the past few years and it’s because returns are likely to be disproportionate.”

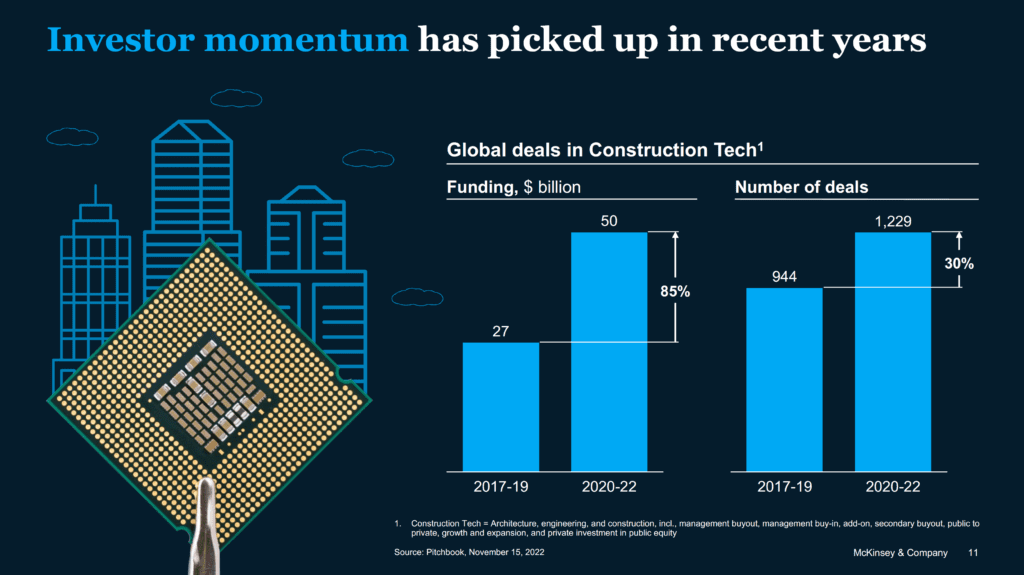

Metzeler draws a line through 2020 to make his point. In the three years previous (2017-19), he cites McKinsey researched data that shows there was USD27 billion investment in the construction technology sphere. But in the 2020-22 period, that investment went through the roof for an 85% rise to USD50b. Deal volume also spiked from a respective 944 to 1,229 for a 30% rise over the same period.

“We think the signals are strong enough to be optimistic that this will continue,” says Metzeler. “We undertook a survey of investor professionals and about two-thirds of them not only expect investments to grow in that space, but they also recognize they are able to generate higher returns than with investments in other verticals.

“It shows that the value creation of technology in construction is increasingly recognized as achievable and it also shows us that more and more investors are seeing construction technology’s potential is fundamentally changing the structure of the industry.”

That is not to say Metzeler sees these changes as a given. Construction’s well-documented complexity “makes penetration of technology very challenging,” he says, with its fragmented nature, vast array of disparate job functions and sometimes entrenched Conservatism, blocking interoperability and acting as a barrier to innovation.

But, he says, there is huge potential in construction precisely because the industry is at the intersection of a powerful cocktail of factors that put technology at the heart of its immediate and medium-term future. And that, he says, could also significantly impact the sustainability narrative as we get closer to the UN’s 2030 emissions reporting targets.

“Jobsites today in many ways resemble those of 1924, with manual bricklaying, paper blueprints and scaffold towers.”

“Whatever you can make better in this space, it is incredible what you can achieve. Take cement as an example. It’s one of our main construction materials and it’s responsible for 8% of global CO2,” says Metzeler. “If we can harness the technology and leverage it for better solutions in construction, then you can see an immediate impact there. The potential is enormous.

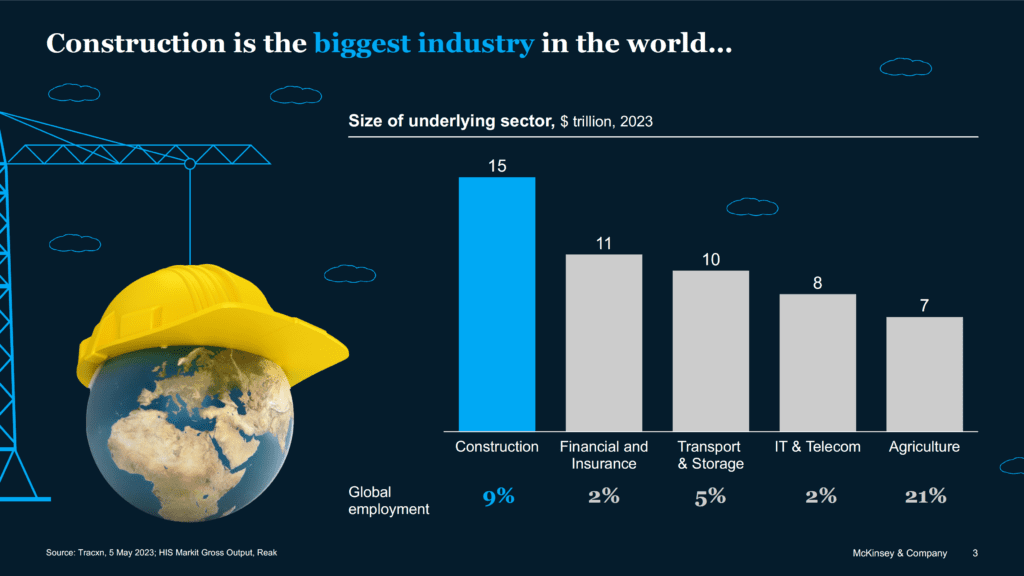

“Construction at the global scale is the largest industry in the world worth circa USD15 trillion, contributing something like 13% of global GDP, and employing nearly one in ten of all workers,” says the McKinsey partner.“It’s responsible for some really impressive accomplishments from stunning city scapes to foundational infrastructure on massive scales.

“But while construction is shaping our environment day to day, it’s also been suffering from low productivity and performance for as long as it has existed,” he says. “Jobsites today in many ways resemble those of 1924, with manual bricklaying, paper blueprints and scaffold towers.”

And the productivity numbers are stark. Metzeler says productivity has risen by less than 1% per year in the last two decades compared to a 2.8% rise per year for the overall economy.

But it’s that very lack of productivity that has caught the eye of investors, he says. The push to meet hard-and-fast UN targets on climate change means Capex investment in construction will need to reach USD600 trillion to keep global warming to a maximum of 1.5 C , requiring the building of 300 million new homes and retrofitting 44 million homes. Throw into the equation the changing composition of the global construction workforce, and the requirement for a more fit-for-purpose industry is evident.

“There is a growing shortage of skilled labor as the example of the US construction industry shows with 440,000 vacancies currently compared to 300,000 in 2019,” says Metzeler. “And with 1 in 5 of construction workers over the age of 50, something like 41% of the US workforce are expected to retire by 2031.” That, says Metzeler, is what will make construction technology so critical in the interim ‘bridging the gap not as a job killer but as a job skiller”.

With a regulatory effect also weighing on the sector – especially on sustainability – that is catalyzing the development of technology in the industry making it more connected and building the foundation for construction to get ready for the challenges ahead.

“In the face of all these factors, the industry has no choice but to adhere to all these demands and make the take up of construction technology an absolute necessity,” says Metzeler. “It’s no longer a nice-to-have. It’s mandatory.

“It’s not about pulling one lever that will solve the problem, that will never happen,” he says. “But I think the construction industry has a range of technologies now which in combination, really need to be accelerated in the next 10 years.”

In the short term, that should see an immediate uptick in IT investment, yet another area where construction lags its peers with the banking and finance sector enjoying an 8.2% allocation versus the 1.2% spend of construction companies.

Metzeler anticipates technology like Gen AI to help lift construction out of its productivity trap with scalable solutions — perhaps on the back of the emergence of Industry Cloud Platforms — unleashing its potential and helping it restore its reputation as a force for progress.

“Construction technology is the key to unlocking the productivity gap and it is absolutely imperative,” says Metzeler. “As long as all stakeholders remain absolutely committed to adopting contech, then the industry will overcome that chasm in productivity.”

“The industry has no choice but to adhere to all these demands and make the take up of construction technology an absolute necessity. It’s no longer a nice-to-have. It’s mandatory.”

That process, says Metzeler, is already well underway, with revenues on the contech side of the industry averaging a per annum rise of 11% in recent years, but that figure is likely to grow significantly as the case for technological take up becomes overwhelming. That should in time see investment in IT slowly but surely become more aligned with other industries.

“There’s a lot of work to do in the next 10 years,” adds Metzeler. “The world needs a more productive construction industry than ever before.

“It’s not unfair to say construction is where a lot of the world’s pain sits today, but if you turn that around, it’s the pinnacle in terms of all the things we’ve built,” says Metzeler. “I feel really lucky that I have been able to combine a passion for construction with technology in the knowledge that it is ripe for big improvements.”

The Interview is a series of articles where we take time out with industry players that are trying to make a difference to construction. Check out some of our other interviews including Clay Eubanks at Takeuchi, The CECE’s Riccardo Viaggi and IPAF’s Karin Nars.

If you missed Fabian’s keynote at Trackunit Next 2024, you can watch the full show on-demand now.