Construction doesn’t have it easy. Despite the fact that it is a USD15 trillion industry contributing something like 14% to overall global GDP, it has never been a favorite of the investment community.

There are many reasons why that is so. It is a hugely complex industry for one and the lack of connectivity is another. That it has suffered from a perhaps outdated perception that it is inherently conservative, inefficient and stuck in the past has also contributed to investors taking their cash elsewhere.

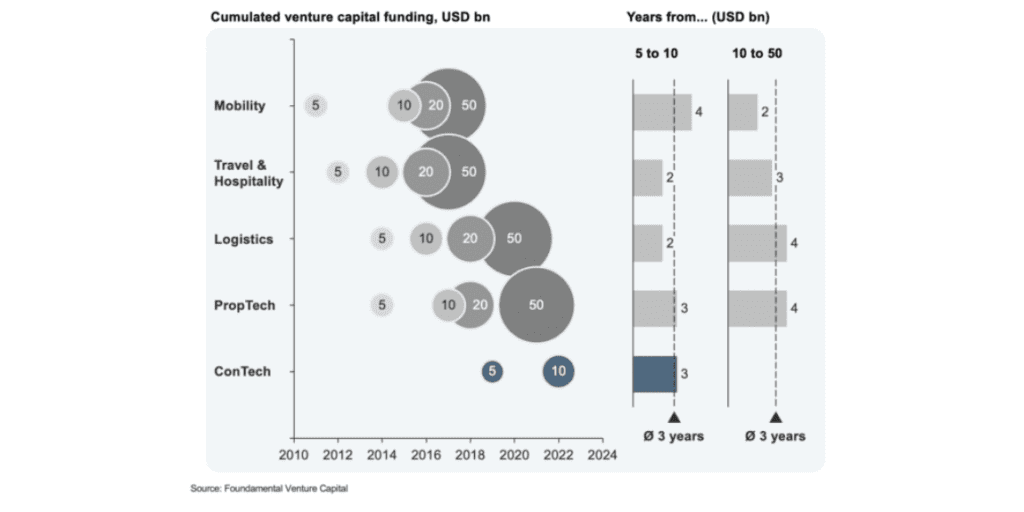

That shows in the figures. Industries like Mobility and Travel & Hospitality had both by 2019 attracted USD 50 billion in venture capital, while Logistics and PropTech both went through the same mark in 2021. ConTech meanwhile was at the end of 2022 languishing at around the USD10b mark.

The contrast is sharp, yet a dig beneath the figures shows a different narrative. It typically takes investment in any given industry 2-3 years to go from USD5b to USD10b as the chart shows. And then the next acceleration over the next three years is USD10 to USD50b, as McKinsey’s Fabian Metzeler so eloquently outlined at Trackunit Next earlier this year.

Just pause a moment and think about that leap. That’s an extraordinary progression in an incredibly short period of time and more to the point, is based on documented evidence where the case has been made and delivered — lock, stock and barrel. In other words, this is not an ‘if’, it’s a ‘when’.

And that’s where it gets interesting for construction because having breached the USD10b mark in 2022, it hit the point at which the next leap became inevitable if all other things remained equal.

But this doesn’t yet seem to have happened. That could of course mean construction is the exception that proves the rule and will not manage to turn USD10b into USD50b, but I don’t believe that is so. It is in fact more reasonable to suggest that things simply stopped being equal.

“And that’s where it gets interesting for construction because having breached the USD10b mark in 2022, it hit the point at which the next leap became inevitable”

After Russia’s invasion of The Ukraine in February 2022, investors backed off from new ventures and many construction projects went on hold. That meant instead of racing towards the USD50b figure for a there or thereabouts landing in 2025 as projected by the likes of McKinsey and others, investment in construction stalled.

But finally, that looks set to change. While no-one would suggest the war in Ukraine is normalized and we should never trivialize the tragedy that is unfolding there, it is from an investor perspective heavily factored in and part of the equation. Indeed, if we took out that macro shock, I’m sure we would already be getting very close to the USD50b benchmark.

Macro shocks such as this impede investment not just from a sentiment perspective but also because they inevitably lead to higher interests and less ROI. But with Central Banks slowly implementing rate cuts and inflation easing, that has once again created the conditions for investment to flourish and for projects to get underway again. That will almost certainly change the landscape for construction over the next few years.

“With Central Banks slowly implementing rate cuts and inflation easing, that has once again created the conditions for investment to flourish and for projects to get underway again”

Perhaps the biggest beneficiary of this will be the Contractor sector. Contractors sit at the very heart of construction occupying the intersection between customer and manufacturer. While that has always been so, in 2024 that matters even more as customers are wielding a power over projects that has perhaps never been witnessed before.

Take sustainability. We’ve seen how projects at national, regional and sometimes even local level have become increasingly stringent on emissions. Contractors that can give verifiable data demonstrating how they are taking action to mitigate against CO2 automatically put themselves in a better place to win big contracts that place a premium on such insights.

That is a play that can also be seen in access management where it impacts safety on the jobsite to prevent costly delays, budget overruns and of course risk to workers, particularly if they are working at height or operating complicated, dangerous machinery.

It can even spill over into diversity & inclusion where construction companies might be required to show they have DEI policies in place that make their company appeal to a broad spectrum of the workforce across gender, ethnicity and age.

All of these together probably help explain why Contractors such as Fluor Corporation, Turner Construction, Bechtel, and Clark Construction Group have become the vanguard of the competitive sustainability phenomenon in North America and European counterparts such as Skanska, Laing O’Rourke and Mace have also been the subject of so much attention over the last few years

This has first and foremost been a result of a cultural shift within these companies, but that has also been complemented by significant improvements in the technology. More robust, IoT-driven technology has armed the contractors with data that has been processed, harmonized and packaged to show project owners that they are indeed taking steps to meet requirements stipulated in contracts.

“More robust, IoT-driven technology has armed the contractors with data that has been processed, harmonized and packaged to show project owners that they are indeed taking steps to meet requirements stipulated in contracts.”

And that’s where capital is likely to flow in ever-increasing quantities giving the Contractor segment the insights it needs to match up to customer expectations. Civil engineers may be able to build things, but if someone’s putting extra demands on their plate, they need help meeting those demands.

Naturally, the emergence of Industry Cloud Platforms are a part of that equation as they will make the flow of data in a secure, stable environment more seamless enabling the industry as a whole to focus on what they do best supported by meaningful insights. We’ve seen how Trackunit’s own Operating Data Platform Iris is evolving into meeting specific aspects of construction’s off-highway sector and the ensuing connectivity will only make the industry more attractive to investors as an organic ecosystem consolidates and organically strengthens.

There’s another factor here to consider too. Those contractors who are most progressive — be it on sustainability, digitilization, safety, DEI, eliminating downtime and the other burning topics in construction — are the ones who will win in the scenarios depicted above. It means a gradual phasing out of old practices, conservatism, inefficiencies and the evolution of a reinforcing wheel that just gets better and better.

Ultimately this comes back to the triple bottom line I’ve mentioned in a previous article — people, planet and profit. The pursuit of all three is not only complementary, it is necessary and the more tech-driven and ready you are, the more those will fall into line enhancing the battle on downtime and raising overall efficiency.

The ones who grasp quickest how to integrate their business with the ICP era will also attract the best talent in the industry as connectivity broadens the horizon to a degree unthinkable a decade ago. That’s why construction will attract the big bucks over the next few years. And that’s why we’ll break through the USD50b figure in venture capital sooner rather than later.