Governments globally are preparing for an even broader spread of the virus. United States, Italy and Spain are the most affected among the major industrialized economies. Trackunit Research believes that despite ongoing, slow Chinese economic recovery, the ongoing spread and different reactions to the covid-19 in Europe and North America will delay broader restart of construction.

We’ve combined data to generate a holistic overview of the covid-19 impact of construction. We call it the Downtime Index. The index is intended to assist construction executives in planning and coordinating a gradient of business-contingency policies in response to a rapidly evolving situation.

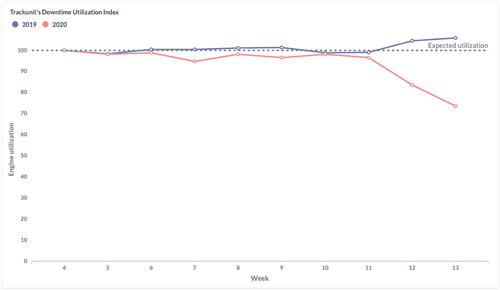

The Downtime Index compiles weekly harmonized engine utilization changes. Engine utilization is defined as voltage activity on a machine’s alternator. We express the changes as index numbers to allow for quick international comparisons. The index starts at week 4 and is referred to as the base week. In subsequent weeks, percentage increases push the index number above 100, and percentage decreases push the figure below 100. An index number of 102 means a 2% rise from the base week, and an index number of 98 means a 2% fall. The underlying data comes from a fully anonymized cohort of approximately 150,000 off-highway construction machines in Europe and North America with high densities in France, Germany, Denmark and the US (40% all together).

The 12.3% decline in the Downtime Index from week 12 to 13 indicates that machine utilization continues to suffer from covid-19 fear and the shutdown of construction sites. In week 13, the downtime index hits the 75th mark. This means that machines are now utilized 25% less compared to what we’d expect and a shocking 30% less compared to 2019.

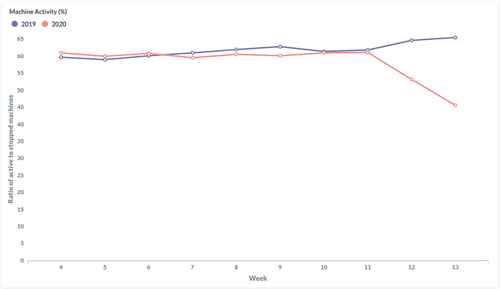

The significant drop in machine utilization is followed by a free fall of the machine activity metric which measures how many machines are working to the total fleet. We see an 18.4% fall from week 12 to 13, which means that only 45% of the machines have been working in the previous week. This is the sharpest seven-day drop we have seen in the Downtime Index since machine utilization started to fall in week 11.

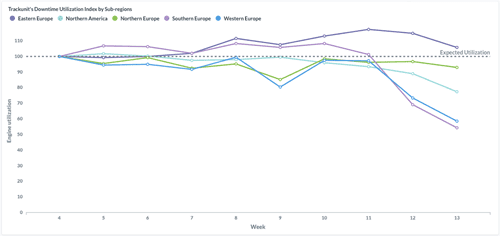

We see strong regional differences across the Downtime Index. Machine utilization has almost halved in Southern Europe whilst Eastern Europe performs better than expected with index numbers pushing above 100. France, Spain and Italy all suffer from a significant drop in machine utilization which in week 13 is only 1/4 of expected.

We think that the following range of actions can help construction executives overcome the ongoing challenge of covid-19’s impact and benefit from it when the economy rebounds.

OEMs shift focus of their in-house engineering efforts:

OEMs engineering departments mostly focus on machine architecture and day-to-day workflows around the assembly line as this ensures the highest quality products. These crisis situations provide an opportunity for OEMs to shift their engineering capabilities towards long term research & development activities. By applying data understanding skills of in-house engineering towards historical machine data analysis, it will help OEMs exploit the full potential of their technology and meet the customers and users where they are.

Rentals systematically review regional demands:

Rentals already carry extensive inventory in regions where lockdown is more present. However, in other regions many depots are lacking the right machine. This calls for systematic review of machine allocation towards higher demand – especially late stage construction machines such as aerial work platforms. Transformation of machine allocation processes and use of data will ensure faster and more objective decisions.

Contractors refine operations and invest in trainings:

Contractors are forced to shut down major construction sites. Safety is a critical item for all construction projects for multiple reasons, including protecting the well-being of employees, providing a safe work environment, and controlling construction costs. Any slow days call for additional training and related operational refinements. Leveraging technology for assistance is one of the most prominent industry trends that contractors can capitalize on even more now. Dedicated commitment to safety trainings will lead to project success and is expected to impact the bottom line considerably.

Get in touch with us in case you have any questions or comments on [email protected]. Share your response or insight on social media with #eliminatedowntime

Ne manquez plus aucune information. Nous vous enverrons un e-mail lorsque de nouveaux articles seront publiés sur ce sujet.