As most construction companies are used and bond to their pen and paper based very human processes, many have had to innovate new capabilities for remote operation almost overnight. Reducing manual workflows and bottlenecks changed quickly from being a goal in executive team meetings into a real quick transformations.

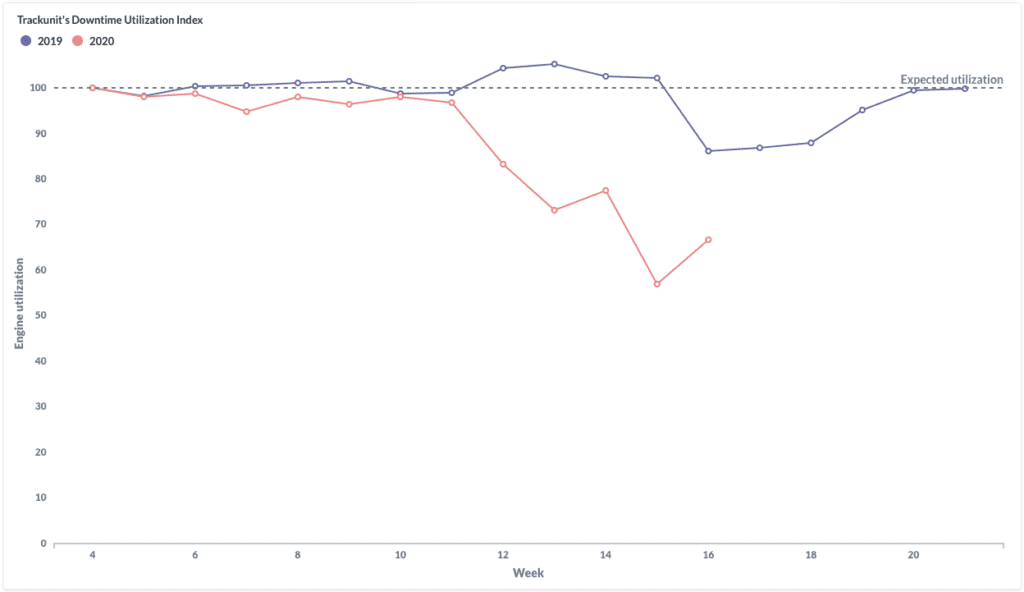

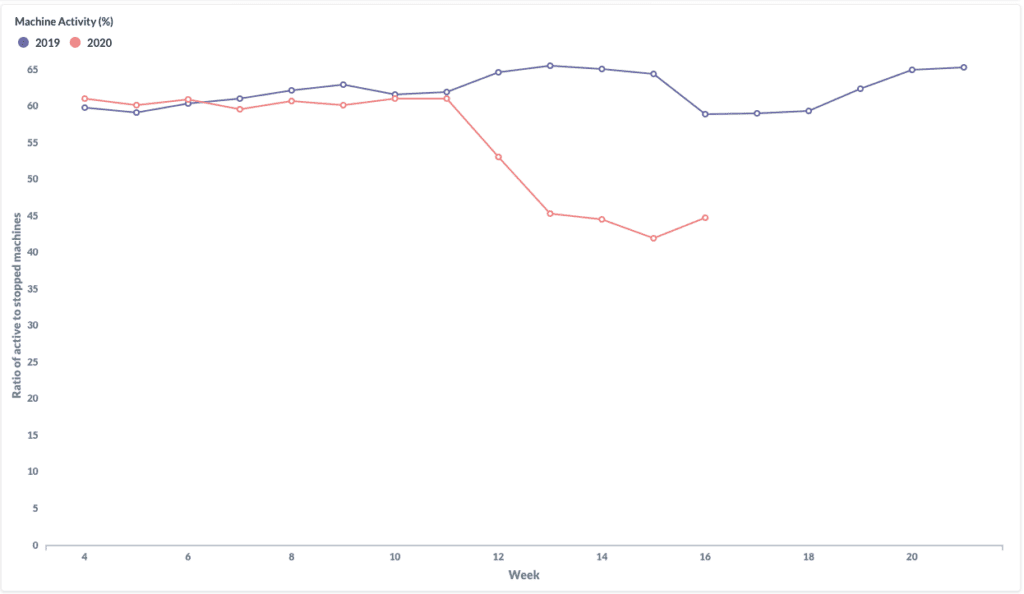

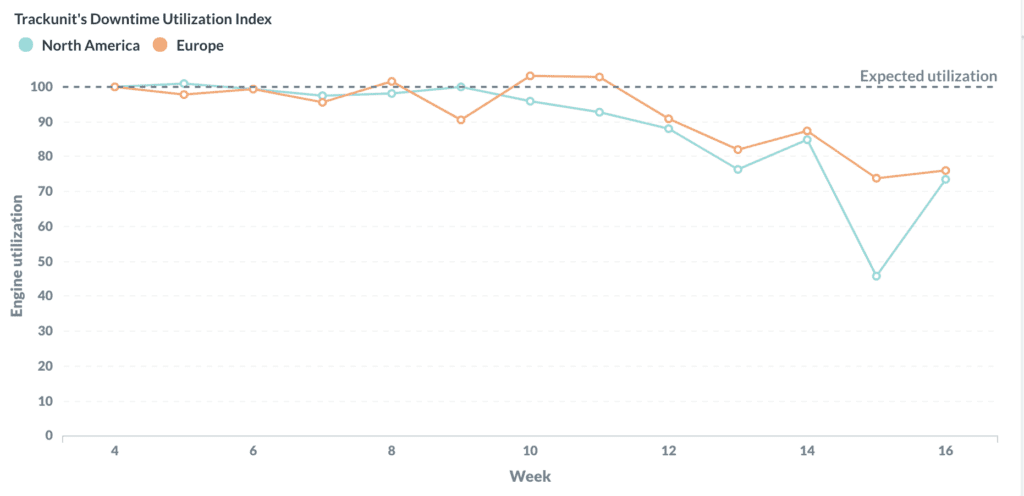

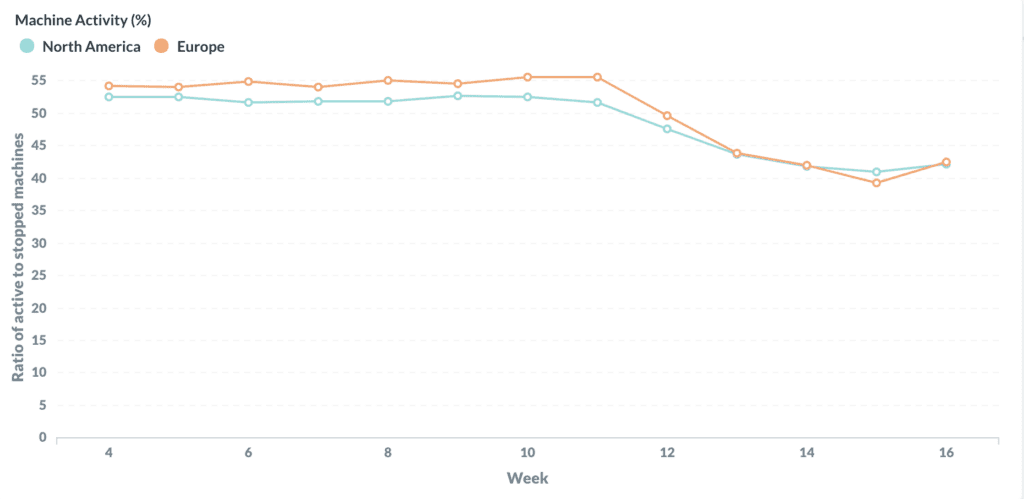

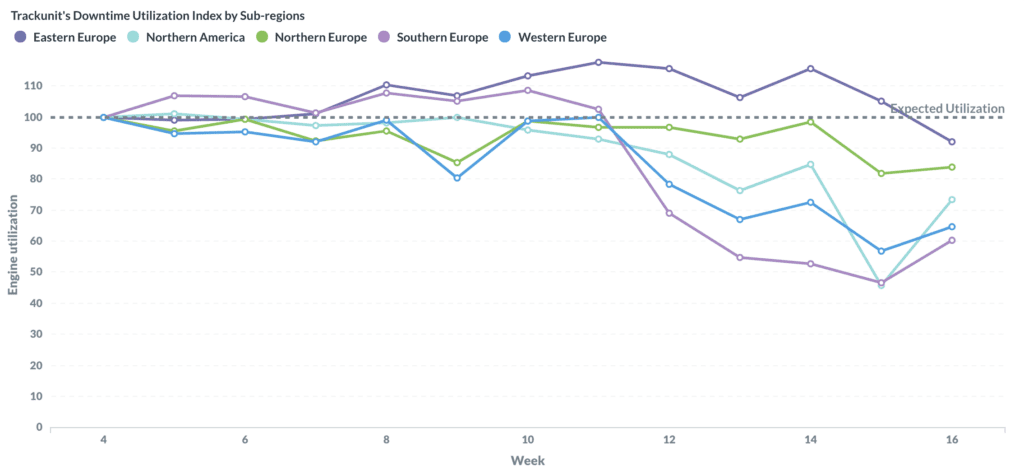

The Downtime Index compiles weekly harmonized engine utilization changes. Engine utilization is defined as voltage activity on a machine’s alternator. We express the changes as index numbers to allow for quick international comparisons. The index starts at week 4 and is referred to as the base week. In subsequent weeks, percentage increases push the index number above 100, and percentage decreases push the figure below 100. An index number of 102 means a 2% rise from the base week, and an index number of 98 means a 2% fall. The underlying data comes from a fully anonymized cohort of approximately 150,000 off-highway construction machines in Europe and North America with high densities in France, Germany, Denmark and the US (40% all together).

Fast Easter recovery

Utilization has increased by 17% from week 15 to week 16. We also see a much higher increase after Easter compared to last year which is a positive indicator of a strong post-Easter recovery. The gap to last year’s utilization shrank a surprising 57% from last week and a gap of 2.25 is the smallest we’ve seen since week 11.

More machines in use

The machine activity rate has increased by 7% from 41.94 in week 15 to 44.72 in week 16. Last year, 9% fewer machines were worked in the same period. Despite positive signals from this important metric, we’re still seeing a gap of 15% to last year’s machine activity rate which means that 15% fewer machines have been worked last week this year compared to last year.

North America bouncing back

Last week, we’re seeing the utilization for North American construction machines skyrocketing with a sharp 60% increase. This shrinks the gap to Europe with a surprising 90%. For the same week, we see a modest increase in Europe of 3% which indicates that the two regions remain equally impacted by COVID-19 fear.

Europe still in the lead

As the machine activity rate increases by 8% for Europe and 3% for North America, Europe takes the lead with 42% of machines being worked at construction sites in week 16. We expect that around 55% of the machines would be active so we believe that there is still a 13% gap to expected machine activity.

Southern Europe in recovery

In week 16, we see a 29% increase in the utilization rate for Southern Europe – primarily driven by a 50% increase in Spain. Eastern Europe still has the highest utilization despite a 12% drop last week. North America shows a sharp increase of 60% whilst Northern Europe remains stable with a 2.5% increase and all-time lowest variance.

We think that the following actions can help construction executives overcome the ongoing challenge of COVID-19’s impact and benefit from it when the economy rebounds.

Rapid Implementation of Digital Tools

As most construction companies are used to and bond to their pen-and-paper-based very human processes, many have had to innovate new capabilities for remote operation almost overnight. Most OEMs have been executing their key sales processes during on-site meetings. Major rentals provided on-site support for their machines. In-person meetings became different. This provided an opportunity to transform manual processes overnight.

Reducing manual workflows and bottlenecks changed quickly from being a goal in executive team meetings into a real quick transformation. Internal IT teams rolled out new tools for video conferencing and online signatures rapidly. This changed the way OEMs interact with rentals drastically. We believe the COVID-19 crisis will be a period of substantial process automation with the help of digital tools. The earliest signs of this is already visible.

Get in touch with us in case you have any questions or comments on [email protected]. Share your response or insight on social media with #eliminatedowntime

So bleiben Sie immer auf dem Laufenden. Wir senden Ihnen eine E-Mail, wenn neue Artikel zum Thema Telematik veröffentlicht werden.